Over the past five years, Convertiv has worked with dozens of clients, many of which represent some of the country’s fastest-growing technology companies. In that time, we have provided guidance in regards to account-based marketing (ABM)—specifically focusing on evaluation, implementation, and operation for all of the leading ABM platform vendors in the marketplace: 6Sense, Demandbase, Terminus, RollWorks, Triblio, and others.

This experience has revealed several considerations to make before purchasing an ABM platform.

Funding the tool, but not establishing sufficient budget to support it

There is enormous value to be gleaned from account-based data (e.g. Intent, Reverse-IP, Propensity etc.), but not securing the necessary funds to take action on that data negatively impacts ROI. You’d be surprised how many companies spend significant money ($100k per year or more) on license fees but devote negligible funds for talent (internal and/or external), advertising budgets, and other initiatives that enable you to put your product, solution and or brand in-front of the intended account-based audiences.

Failure to engage other stakeholders beyond the marketing department (e.g. IT, Data, and Sales)

If a company only empowers a marketing department in the evaluation of ABM platforms – or other marketing technology for that matter, the company may inadvertently invest in redundant or inadequate technologies. Engaging stakeholders from other areas of the business will change the dynamics of the conversation. Future success certainly requires the input of the sales team, but IT and/or Data teams should also be included in the evaluation process. Technical team members will likely focus on requirements not typically prioritized by sales and marketing like where the data is generated (and who owns it), as well as if the company already has access to the same data stored in an existing cloud data warehouse.

Be mindful of redundant tooling and restrictions on where the data is allowed to go

ABM Platforms are essentially B2B Customer Data Platforms (CDPs). They are purpose built to pull in multiple data sources and provide consolidated customer records, enrichment and an activation layer. Often, we find most of these capabilities already exist in client stacks or via an OEM. These include:

- Lead-to-Account Matching (e.g. Cloudingo, Leandata, etc.)

- Reverse IP and Firmographic Enrichment (e.g. Kickfire, Clearbit, HGInsights etc.)

- Intent data (e.g. Bombora, G2)

- Account Scoring (Platform specific if applicable)

Account or propensity scoring is typically where the value comes in for these platforms, as they package this up nicely. Depending on the vendor, much of this data is not available outside of the ABM platform via API (as many times they are OEMing some mixture of the above). However, for data (and budget) conscious clients, account scoring can be achieved with AI/ML knowledge, as long as the raw intent and 1st party data is accessible.

Do I really need another platform for this?

If some of the above tooling is already something you are working with today, it begs the question of whether you really need another platform to support ABM initiatives. Additionally, most of our clients are looking to or already replicating their enterprise data into the cloud (e.g. Databricks) via the Modern Data Architecture for a multitude of use cases. That got us thinking. If the lion’s share of customer data (e.g. SFDC, Marketing Automation, Web/Product Events) is already in the cloud, why can’t it be segmented for an ABM use case and activated just like a Composable CDP?

Eureka!

By deploying a Modern Data Architecture, instrumenting it for B2B data capture (1st and 3rd party), and utilizing the tools and data that our clients already have, we can retain 90 percent of an ABM Platform functionality at a fraction of the cost. In the process, we can eliminate tool redundancy and cost, which can then be reinvested into data activation (e.g. additional program dollars).

Best of all, through this scenario, companies can preserve ownership of all of the data.

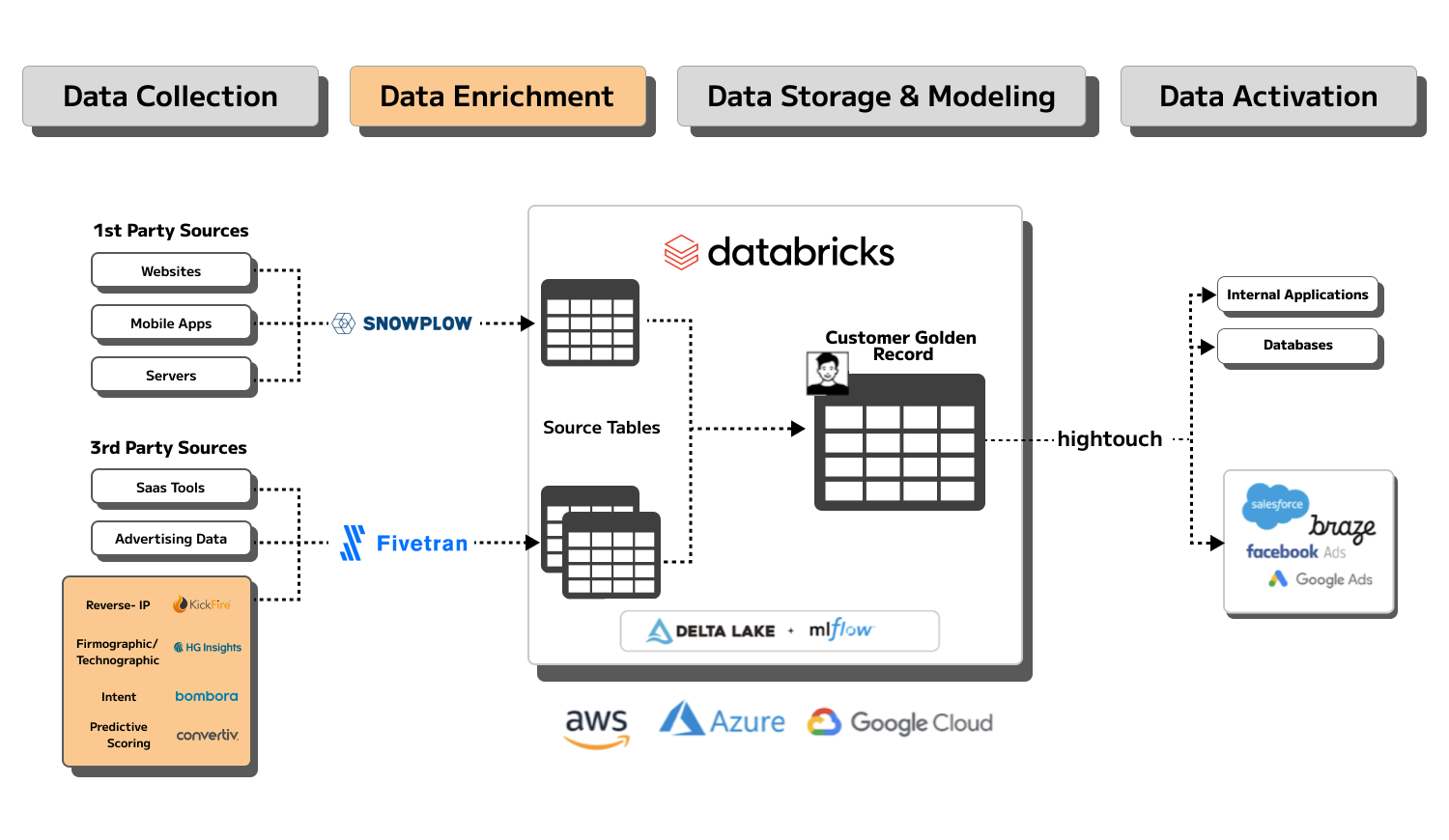

We took the liberty of adding some enrichments to the widely shared Data Product Accelerator for Composable CDPs from Snowplow (in partnership with Databricks, Fivetran, and Hightouch) to satisfy typical ABM use cases. Getting the data product accelerator up and running is a great start, but modeling and enriching the data for activation can be difficult even with a team of data engineers. Fortunately, we have created the processes to manage that workflow, including enrichment with Reverse IP, intent, and created models for custom account scoring (aka Propensity Scoring). To ensure confidence in the data, we also help clients properly configure SFDC, marketing automation (MAP) and web/app events to capture data aligned to their insight requirements. This unlocks additional possibilities for B2B use cases within a Modern Data Architecture (e.g. Attribution, PLG etc.).

For data activation, we rely on our friends at Hightouch to route that data (e.g. Account Score, Company IP Visits) back into SFDC and to create account-based advertising audiences (e.g. LinkedIn Ads) by domain or first-party match. For intent, we recommend clients get Bombora (and G2 if applicable) with API access. And lastly we leverage Snowplow for 1st party event collection, which is then enriched with Kickfire Reverse-IP (or Reverse IP of client choice) and other client specific models. This allows you to dive deep into your target account activity to see when and how they’re engaging and determine when is a good time to reach out.

Net-Net

All-in-one solutions for ABM do provide unique value and in the right scenarios may better at satisfying requirements vs a composable approach. However, companies that are evaluating ABM vendors or looking to consolidate tooling in 2023 should first consider utilizing or extending their Modern Data Architecture as per the above and in partnership with other stakeholders (e.g. Sales, IT and Data Teams). Selecting an “all-in-one” platform for ABM may not always make the most sense, as it’s likely you already own much of the required best-in—breed technology.